Sage Mortgage: Sage Mortgage is an online company that underwrites loans and works alongside multiple wholesale lenders. The brokerage was established in 2020. It is located in Fort Mill, South Carolina. You can connect to Sage by submitting your information via Bankrate, an affiliate firm, or visiting the company online to submit an application. You’ll then be assigned a loan officer. The company will assist you in finding a loan and can provide preapprovals within one to two days. On average, closings take 27 days.

Sage Mortgage’s mission is to empower you to make better decisions when financing your home. Find refinance rates online quickly and securely.

The borrower benefits from Sage Mortgage’s 100 % digital experience. This allows for applicants to submit support documents and choose the right products and prices all within one go. (The broker’s website isn’t complete with information, however.) If the lender allows it, the borrower may also sign electronic documents. Anyone who is who are interested in working with Sage is able to connect with Sage’s broker by text, email, or chat.

Sage Mortgage Value

Refinancing and buying a house should be easy.

Expert guidance is required to make the home financing process easy.

Modern home financing problems deserve updated solutions.

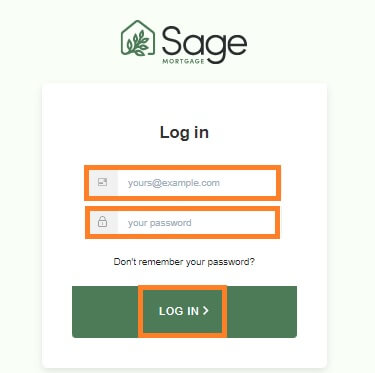

How to Sage Mortgage Login Online?

Suppose you want to know how to Sage a mortgage login online. In that case, this article is significant for you because, in this article, Money Subsidiary explains sage mortgage login step by step, so follow the given steps carefully.

Step 1: First of all visit the official website of Sage Mortgage [https://sagemortgage.com/]

Step 2: After that click on Sign in.

Step 3: After that enter your registered email address and password.

Step 4: After filling, in the login details click on Log In.

Step 5: You are login in successfully to Sage Mortgage.

After following the above steps, I hope you can quickly Sage Mortgage Login; if there is any confusion or any issues, you can repeat this process or contact Sage Mortgage Customer Service at (877) 219-6115.

How to Reset Sage Mortgage Login Password?

Step 1: First of all visit the official website of Sage Mortgage [https://sagemortgage.com/]

Step 2: After that click on Sign in.

Step 3: After that click on Don’t remember your password?

Step 4: After that enter your Registered Email address.

Step 5: After entering the email address click on send mail.

Step 6: After that open mail and click on the active link and reset the password.

After following the above steps, I hope you can easily Reset your Sage Mortgage Login Password. If there is any confusion or issues, you can contact Sage Mortgage Customer Service at (877) 219-6115.

How to Apply for Sage Mortgage?

- It is possible to apply for a loan for your home from any device within minutes

- They have a completely digital mortgage application, powered by BeSmartee

- You can connect financial accounts, scan/upload files, and even eSign disclosures

- All of this can be handled 24/7 through an online loan for borrowers portal.

Sage Mortgage seems to want to make it simple to apply for a mortgage for your home, by using what they call a “fully-digital application.”

You can start by using any device. Simply go to the website, and then click “refinance your home.”

They’ll then inquire about the address of your property as well as the property’s type and the current value as well as the loan amount. They’ll also inquire whether you’d like to take cash from your property.

After you’ve completed the basic steps, they’ll request to run a credit check that is soft that won’t impact the credit score.

My guess is that when you’ve completed that step, you’ll be capable of obtaining your hands at some interest rates for mortgages!

If you are satisfied with the design then you can submit a formal application on their website by submitting a paperless application.

They have their loan applications powered by BeSmartee One of the leading players in the world of digital mortgages.

It permits borrowers to import bank statements as well as automatically check employment and income.

You can sign disclosures electronically and get access to the most current mortgage rate rates and accurate fees from third parties.

After you have submitted your loan You can track your loan’s status by accessing their online portal for borrowers.

Overall they must make it quick and simple to request (and hopefully be approved for) the home loan.

Types of Loan Providing Sage Mortgage

- Conventional

- Fixed-rate

- Adjustable-rate

- Rate-and-term and cash-out refinancing

- Jumbo

Sage Mortgage Fees: Common fees charged by lenders and brokers associated with Sage Mortgage can range from none at all three percent or more of the amount of the loan. The lender requirements change constantly So, make sure to check with Sage Mortgage for the latest charges and fees.

Rates: Sage Mortgage is a broker who works with a variety of mortgage lenders to provide you with the best loan for your requirements. While it promotes a discount price on its website, the personal rate will differ according to the lender you deal with as well as your credit score and other variables. You can get a customized rate quote by filling out an application on the website of the broker or via Bankrate as well as by calling your lending agent directly.

Minimum borrower requirements: To qualify for conforming loans applicants must have an average credit score of 620. They may have a maximum debt-to-income (DTI) ratio that is 50 percent, and a maximum loan-to-value (LTV) percentage of 95 percent.

Sage Mortgage Online services: Customers can benefit from Sage Mortgage’s completely digital experience. This allows them of applying, upload documents and pick out products and prices all in one go. (The site of the broker has only a little information but it does have a lot of information.) If the lender is in favor they can also sign electronic documents. People who are interested in working with Sage are able to connect with the broker through text, email, or chat.

Refinancing through Sage Mortgage: Refinancing borrowers who want to refinance their current mortgage can find affordable rates from Sage Mortgage, which works with a variety of lenders to get the best loan that has the lowest rate and costs. The broker offers a discount refinance rate online, however, this isn’t always indicative of the rates you’d be eligible for.

Overall Review Score of Sage Mortgage

- Affordability: 5/5

- Availability: 5/5

- Borrower experience: 4.7/5

Sage Mortgage Features

- Work with multiple wholesalers to provide affordable rates and speedy cycle times.

- Borrowers can submit a simple and simple application online all year round

- A dedicated loan officer is available to the borrowers throughout the entire process

- Most mortgages are paid off within 27 days

- It doesn’t offer VA loans.

- Don’t offer home equity loans as well as home equity lines of credit (HELOCs

Sage Mortgage Customer Service

Call : (877) 219-6115

Email: Support@sagemortgage.com

Visit:

- 1423 Red Ventures Drive, Suite 505, Fort Mill, SC 29707

- 3801 PGA Boulevard, Ste 555, Palm Beach Gardens, FL 33410

- 9600 N. Mopac Expy, Suite 500, Austin, TX 78759

HOURS OF OPERATION

- Sunday Closed

- Monday 8:00am – 8:00pm

- Tuesday 8:00am – 8:00pm

- Wednesday 8:00am – 8:00pm

- Thursday 8:00am – 8:00pm

- Friday 8:00am – 8:00pm

- Saturday 10:00am – 4:00pm

Sage Mortgage Important Link to Access Easily:

- Borrower Portal: https://borrower-portal.sagemortgage.com/login

- Sage Mortgage Homepage: https://sagemortgage.com/

- Sage Mortgage About Page: https://sagemortgage.com/about

- Sage Mortgage Refinance: https://sagemortgage.com/refinance

- Resources: https://sagemortgage.com/resources

- Privacy: https://sagemortgage.com/privacy